maryland earned income tax credit stimulus

If you are neither a Full-Year Resident nor a Part-Year Resident you are not a resident. The state also gave out a stimulus check between 300 dollars and 500 dollars for those who filed for earned income tax credit.

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

Governor Larry Hogans office indicated in its Web page that this relief begins with immediate payments of 500 for families and 300 for individuals who applied for the Earned Income Tax Credit.

. Find out what to do. Under the bipartisan Relief Act of 2021 stimulus payments of 300 and 500 went out to Marylanders who received the earned income tax credit on their 2019 state tax return. The earned income tax credit would be an increase to the current one.

Maryland earned income tax credit stimulus Thursday February 24 2022 Edit. The Maryland RELIEF Act of 2021 consists of emergency economic impact payments for low to moderate income Marylanders who filed for and received the Earned Income Tax Credit EITC on their 2019 tax return. What is the Maryland RELIEF Act of 2021.

For example if you owe taxes for a prior year but expect a tax refund in the current year the federal government doesnt view this as an. The Maryland earned income tax credit EITC will either reduce or. To qualify for a stimulus payment you must have a valid social security number and received the maryland earned income credit eic on your 2019 maryland state tax return.

Maryland will send 500 stimulus payments to families and 300 for individual taxpayers who filed for the earned income tax credit within the. For 2021 the federal earned income tax credit ranges from 1502 to 6728 depending on tax-filing status income and. If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident.

Marylands median income is among the highest in the country but the state also has a large low-income population. This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus for EITC filers that would provide an additional 250 for. Paper checks are being mailed by the last three digits of your zip code and will continue to be sent through january 11 2022.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification number ITIN and if you have at least one qualifying child then you may claim one-half 50 of the federal credit on your Maryland return.

The earned income tax credit eitc is a benefit for working people with low to moderate income. The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last year went to 440000 of the states 32. In 2019 nearly 1.

Supporters of the bill say that allowing taxpayers without Social Security numbers to collect Marylands Earned Income Tax Credit EITC will provide much-needed aid to many essential workers who. Did you receive a letter from the IRS about the EITC. Page 1 of 3 Contact information.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Marylanders would qualify. See instruction 26 in the Maryland Tax Booklet for more information on claiming the Earned Income Credit.

Marylanders would qualify for these payments who annually earn. Maryland will deliver new stimulus check to its residents Photo. Find more information about the Recovery Rebate Credit on the IRS website.

Individuals and families with children can get a 1400 check under the program. The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit. To spouses who filed a joint return for a surviving spouse or head of household.

For and claimed the EITC in Tax Year 2019 will receive direct stimulus payments of the following amounts. To be eligible for the credit a single filer with no kids. The credit would increase to 415 starting for the current year.

Similar to federal stimulus payments no application for relief is necessary. This webpage provides information on payment eligibility and additional information regarding the. Residents of maryland who have filed their 2019 maryland state tax return.

Right now the earned income tax credit is based on the federal earned income tax credit. Individuals will receive 300 while those with children will get 500. Residents in Maryland will receive their state-wide stimulus check only if the individual filed their earned income tax credit.

Maryland will send 500 stimulus payments to families and 300 for individual taxpayers who filed for the earned income tax credit within the. See this page on states. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

Provides direct stimulus payments for low-to-moderate income Marylanders with benefits of up to 750 for families and 450 for individuals. Like federal stimulus payments you dont need an application for help. The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses.

To individual tax filers. You may claim the EITC if your income is low- to moderate. The money is being sent out through the Maryland Relief Act.

To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax return. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Wusa9 Com

Earned Income Tax Credit Wikiwand

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Schedule 8812 H R Block

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Earned Income Tax Credits By State Explained Can You Get Up To 6 700 Extra

Earned Income Tax Credit Wikiwand

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Irs Child Tax Credit Payments Start July 15

Earned Income Tax Credit Wikiwand

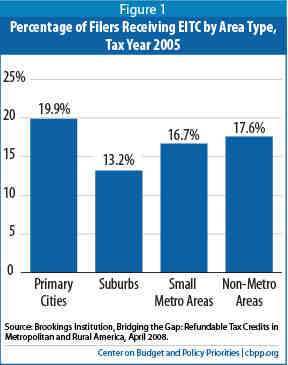

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

How Do State Earned Income Tax Credits Work Tax Policy Center

Child Tax Credit What We Do Community Advocates

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Irs Beware Of Scammers Trying To Cash In On Child Tax Credit Payments